We've raised £1m for UK cancer care charity, Maggie's!

25 Apr 2022We are thrilled to announce that we have raised £1million for UK cancer care charity Maggie’s, since our partnership began in 2016.

In a recent presentation to AUDE members, Sir Robert McAlpine colleagues described their experiences and approach within the current volatile market, together with suggestions of how we might find some solutions.

Different waves of Covid-19, Brexit uncertainty, and the war in Ukraine are just a few of the challenges that have impacted the global supply chain recently, and are showing no signs of abating soon. The challenges this places on the construction industry and its customers are wide-ranging and run deep. So, what can we do to overcome or alleviate them?

In a recent presentation to AUDE members, we offered our perspectives from three slightly different points of view within our business. Russell Day, Education Sector Head, chaired a discussion with Steve Hudson, Group Commercial Director; Chris Davison, Head of Material Procurement and Simon Poulter, Head of Procurement and Supply Chain. Each described their experiences and our approach within the current volatile market, together with suggestions of how we might find some solutions.

Throughout the proceedings, we invited AUDE members to participate in a survey to share their own experiences regarding supply chain challenges. The results are at the end of this piece.

Chris Davison first set the scene with ‘Material Inflation – The facts, the data and the trends’ and gave a comprehensive overview of the market intelligence and trends construction has been facing recently. He highlighted that there were many other reasons for challenges within the supply chain, apart from Covid-19, Brexit and Ukraine. These included rapid fuel price rises, the breakdown of trade agreements between the US and China and the high global demand for raw materials. Although the post-Covid-19 recovery was gaining momentum, the war in the Ukraine has largely stalled this.

Chris then gave an overview of how these circumstances are impacting on prices of key materials in the UK. For example: 43% increase in steel reinforcement during 2021 and into 2022 and an 86% increase in structural steelwork; brick prices are being pushed up by gas prices and have currently increased by 16%; besides, there is still a shortage that stems from production shutdown during Covid-19. Similarly, other key items have suffered significant price increases, such as timber, plasterboard, cement and logistics to name a few.

Next, Simon Poulter discussed ‘Supply Chain Management – relationships, management and integration’. When it comes to supply chain management, he pointed out the value of developing and maintaining strong strategic relationships with suppliers. This enables mutual trust to develop, allowing for greater surety in our supply chain, which is essential for critical materials. This relationship can also lead to collaboration with suppliers where innovations can occur, which benefit everyone.

Simon pointed out that we have many such strong relationships: 75% of our annual supply chain spend goes to only 300 out of circa 2,000 suppliers. We also have around 80 of our supply chain partners sitting in the ‘high-risk, high-value’ space. The need and value of working with these partners in a much more specific and dedicated way is clear. We work to involve them as early as possible, share intel when we can and openly discuss the development of future work. This all leads to a much more stable pipeline of supply. (For further insight from Simon, we invite you to read “Collaboration will help us weather the inflation storm”, which he recently wrote for Construction News).

Finally, Steve Hudson presented ‘Board-level insight – initiatives and approaches’. He reiterated the fact that this had been an unprecedented time across the supply chain, which has hit not just contractors but also clients. However, it is vital that we do not let this become a vicious circle where uncertainty leads to stopping the delivery of projects.

The recent challenges have highlighted a key issue within the construction: productivity has not increased in construction as fast as in other industries. Taking 1997 as the ‘100’ baseline, by 2017 construction has risen to 110 while manufacturing has achieved 155 (source: McKinsey & Company; The construction productivity imperative). Why is this? A number of reasons can be put forward, including construction being a fragmented industry, and there has not been enough investment in technology, which has seen the commercial decision to aim for a low level of profit on turnover (which means lower R&D and investment). In short, the traditional model of construction on a transactional basis is broken and better ways of working are needed, and indeed some are already in place.

Steve highlighted how there have been various workgroups, reports and research projects which aim to investigate and resolve these problems, not least the UK Government’s Construction Playbook. They have each come up with similar solutions, which include the need to work together to find a system that gives best value for both constructors and clients. They also promote the use of the latest technology more effectively, which will drive progress, e.g. DfMA, BIM, etc. Finally, they promote the need for stable, long-term relationships between all involved.

He concluded by discussing the use of data, do we have enough data to make the right decisions when it comes to business and business relationships? One thing he felt all sides could agree on. It is time for change, but can individual companies and clients make the change we need?

This revolved around a number of themes associated with certainty, risk models and mitigation measures.

With few positive signals at present, demand remaining high and pricing trends continuing to rise, it’s difficult to get cost certainty or a forecast more than two or three months ahead.

We need to create a positive project environment that focuses on projects’ key value drivers and how to make projects deliverable, be it through scope analysis, design or other means of appropriate best value risk allocation to ensure project are brought back within the funding envelope.

With Construction Playbook principles in mind, earlier advice, early contractor and supply chain involvement can all help arrive at the best value solution by whatever means.

When questioned about arriving at fixed price or fluctuating price arrangements in such a volatile market, the team focussed in on the mitigation measures discussed (those within the Q3 in the poll below), and a collaborative culture where everything is on the table - making the right decision together.

Taking the opportunity to poll those who attended, asking some insightful questions regarding the current market factors, mitigation measures and fears. The resulting responses were as follows:

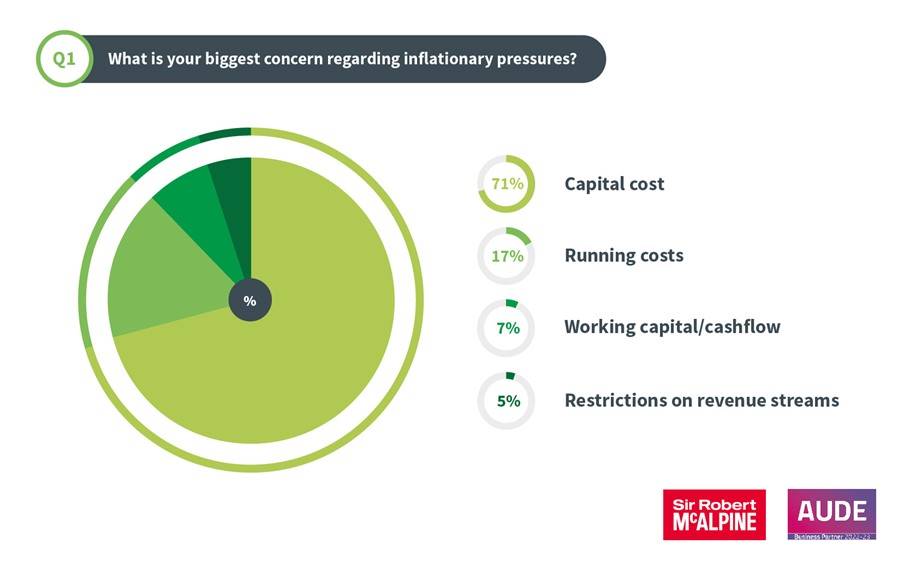

Q1: What is your biggest concern regarding inflationary pressures?

As you can see, a significant 71% of those surveyed expressed concern about rising capital costs: perhaps not surprising given the cohort of mainly Directors of Estates.

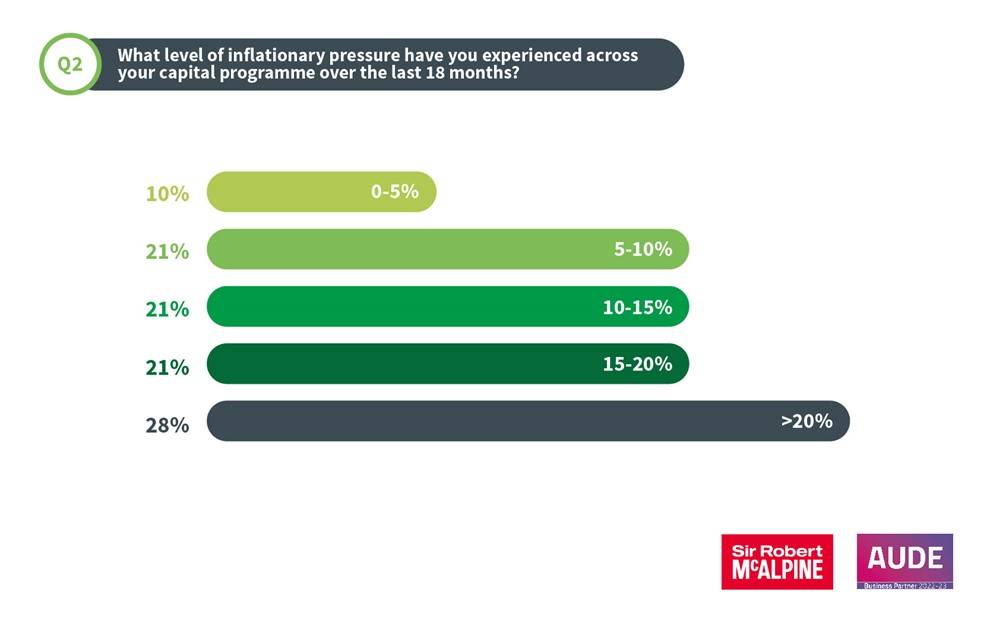

Q2: What level of inflationary pressure have you experienced across your capital programme over the last 18 months?

70% had experienced inflation over 10% with almost a third experiencing over 20%

Moving forward to consider mitigation measures, and procurement tools and processes at their disposal, we asked:

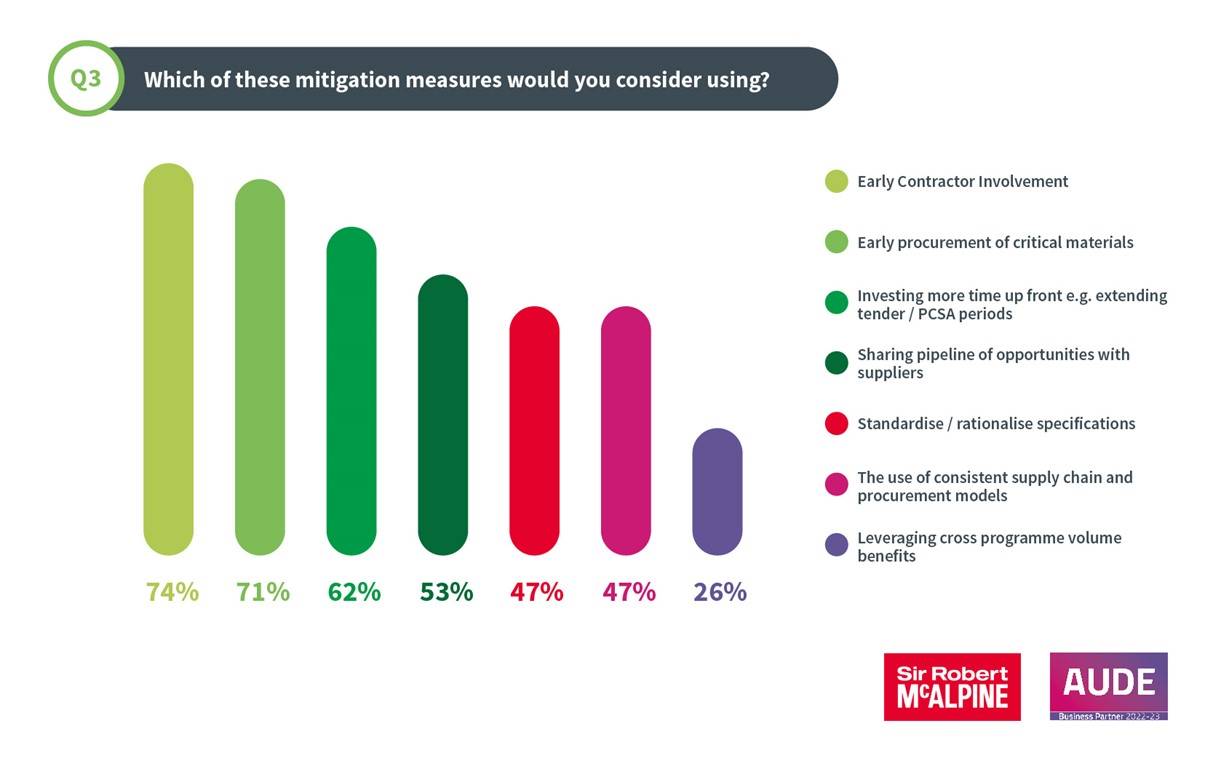

Q3: Which of these mitigation measures would you consider using?

Most agreed that early contractor involvement, early materials procurement and more time invested up front were the most likely mitigation measures they’d use.

Perhaps reflecting how most capital projects are procured in the sector, leveraging cross programme volume benefits came out lowest – food for thought, as we look for innovative ways to tackle the challenges we all face.

And finally, we discussed and polled the attendees’ approach to the Construction Playbook:

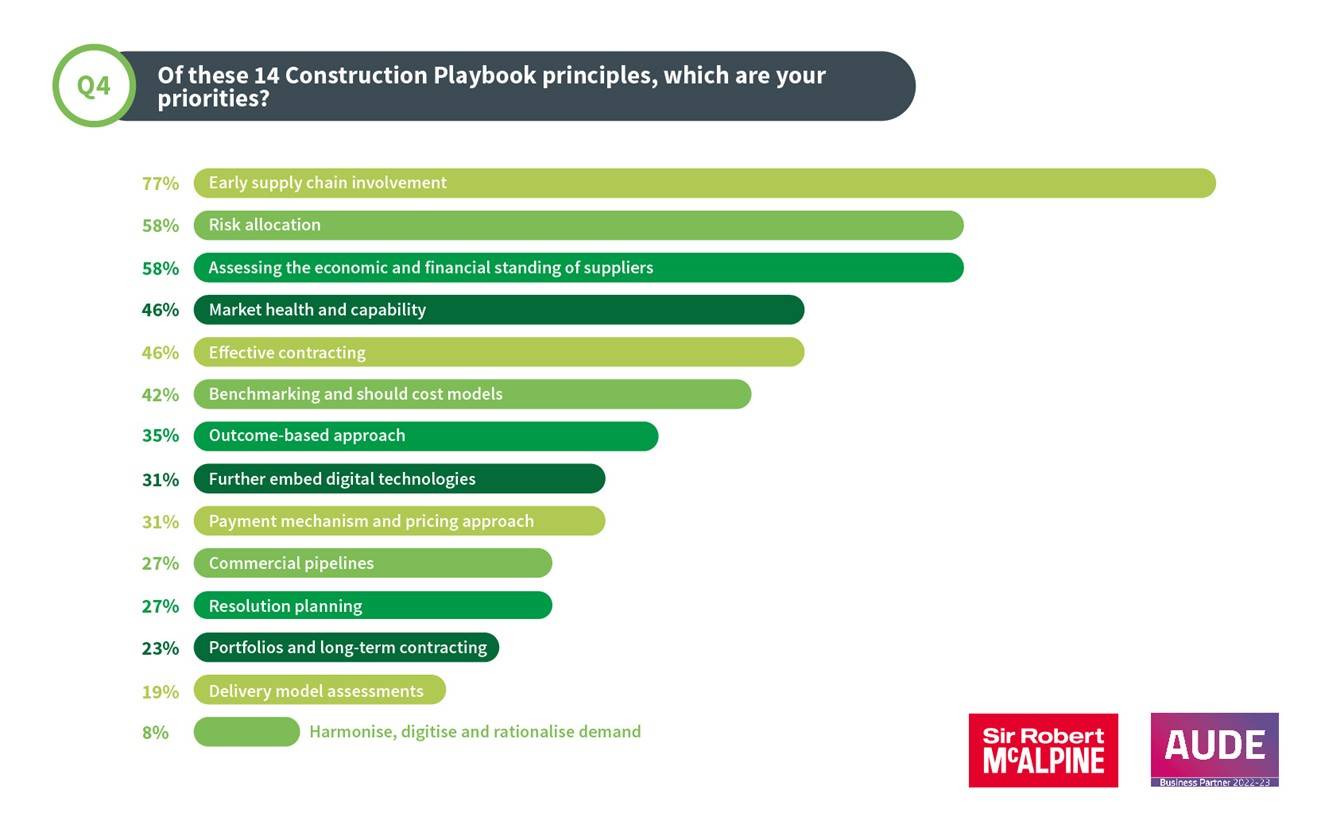

Q4: Of these 14 Construction Playbook principles, which are your priorities?

Again, there was a clear consensus between attendees – the value of early supply chain involvement came out loud and clear, as did fair allocation of risk and the sound financial standing of construction partners and supply chain.

Again, there was a clear consensus between attendees – the value of early supply chain involvement came out loud and clear, as did fair allocation of risk and the sound financial standing of construction partners and supply chain.

We are thrilled to announce that we have raised £1million for UK cancer care charity Maggie’s, since our partnership began in 2016.

Company Carbon Manager, Simon Leek, shares insight into how the demolition and enabling works at 1 Broadgate in London have adopted circular economy principles.

Congratulations to those charity and community projects in Birmingham that have been awarded a share of our Hockley Mills community fund via Action Funder.